Risk Management & Human Behaviour

What decides whether an organisation operates within risk frameworks? Is it the policies in place, the business strategies that push up against those policies, what’s the deciding factor?

In 2016 more and more people are accepting something which even though it’s very simple, has long been a difficult concept for many risk and compliance professionals to grasp – it’s human behaviour. The personalities and psychology of the people making decisions will always be the single most important factor in whether your company can successfully operate in a tightly regulated environment or whether you will face insurmountable challenges.

Psychology and character have always played a role in risk, with Finance Professionals often complaining about nervous, paranoid Risk Managers who aren’t willing to allow the type of risk-taking – -behaviour needed to achieve the biggest possible profits. I’m hopeful that the rise of Behavioural Risk Management will help to break down these stereotypes and enable the different business areas to communicate and collaborate more efficiently.

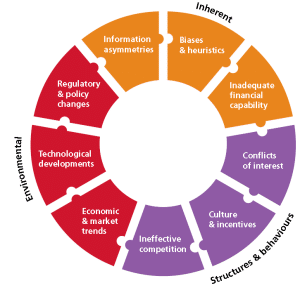

Behavioural Risk Management applies a psychological framework to the decision-making process of every individual within an organisation. Every decision made by an employee has an impact on the level of risk that an organisation is currently managing. More popularly this process is housed under Conduct Risk – which takes into account inherent behavioural aspects as they relate to increasing or decreasing risk exposure.

A Conduct Risk strategy that relies entirely on projecting future risk breaches based on past incidents, will most likely not be as powerful a preventative as a Behavioural approach that considers the distinct personalities of your personnel, especially the most exposed individuals. Over recent years, organisations have started to move away from Psychological Profiling (regardless of seniority) and adopted more of an Informal, Conversational structure to assess team-fit and culture-fit – should we be looking to Psychometric Testing when appointing new people into risk-exposed roles?

Talk to Kind Consultancy if you’re interested in a review of your interview and hiring process, or your wider risk resource needs. Contact us on info@kindconsultancy.com or call 0121 643 2100.